pay ohio county taxes online

Makes it easy to pay Ohio property taxes using your favorite debit or credit card. All payments are time-stamped to insure on-time payments For Information on COUNTY TAX LIENS Call Deana Stafford 330-451-7814 Ext 7160.

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Phone payments can now be made by calling 1-844-598-1300.

. If you have any questions please call us in Delaware at 7408332480. Online E-Check only 150 flat rate fee applies if under 10000 you can use this option by changing the drop down from creditdebit to electronic check under payment method. Must have tax payment coupon with you.

No Credit Card payments will be accepted by mail. Pay by e-check or creditdebit card. Box 188 Wheeling WV 26003 304 234-3688 Online Property Tax Payment Enter a search argument and select the search button Internet Tax Inquiry Internet Fire Inquiry Internet Fire Fee Payment The information herein is a public record of the Ohio County Sheriff.

Pay Taxes Online You may pay your real estate taxes online subject to a convenience fee. Mail your check or money order and the bottom portion of your tax bill. Debit or Credit Card Payment - 225 flat rate per transaction eCheck - 090 flat rate per transaction Telephone payment option - call 855 925-1665.

No more than 1 parcel may be paid per phone call. You the user of this Website are responsible for insuring payments have been made funds settled and credit applied. Please visit the Point and Pay website or select the link button below for payment and convenience fee details.

By Phone -Automated payment free 1-833-819-5111. Welcome to the Cuyahoga County Treasury Website. 800 am - 500 pm Monday through Friday Phone.

After authorization of your payment you will be given a confirmation number that you should keep for your records. Pay Taxes Online Through Official Payments Corp The Treasurers Office is not able to accept Credit Card payments in the office. To edit please follow these steps.

These convenience fees are not collected by Highland County and are non-refundable. Eastern time will be processed on the next days date. You can make a one-time payment or set up an account that will allow you to track your parcels sign up for e-billing text alerts and more.

Call 1-800-272-9829 to pay by creditdebit card Drop Box. Any payments made after 800 PM. Located at the County Administrative Headquarters 2079 E 9th.

Where Can I Pay My Lorain Taxes. 911 Communications Animal Shelter - Dog Warden Development Authority Elections Voting Emergency Management Emergency Medical Services Finance and Accounting Wheeling - Ohio County Airport Flood Plain Management WVU Extension More. You may even earn rewards points from your card.

Point and Pay is authorized by the Union County Treasurer to. Penalties and interest will be incurred after 800 PM. Box 188 Wheeling WV 26003 304 234-3688 Online Tax Record Search Enter a search argument and select the search button Pay your taxes online Internet Tax Payment Internet Fire Inquiry Internet Fire Fee Payment The information herein is a public record of the Ohio County Sheriff.

For creditdebit card or eCheck payment by phone call 1-866-288-9803. 4 Select Edit and enter the amount you wish to pay. IBM_HTTP_Server at taxohiogov Port 443.

Ad Submit Your Ohio Dept of Revenue Payment Online with doxo. CreditDebit Cards 250 200 minimum E-Checks - 150 per. 2 Add the selected property to your cart by selecting Add to Cart.

Pay by creditdebit cardEcheck. 187 Rising Sun IN 47040. Has to be postmarked before due date anything postmarked after due date will be subject to late.

Ohio County Sheriffs Tax Office 1500 Chapline St. Available 247 the departments online services can help you electronically file an Ohio IT 1040 SD 100 andor IT 10 while providing detailed instructions and performing calculations as you complete your return. Point Pay charges 150 per electronic check payment.

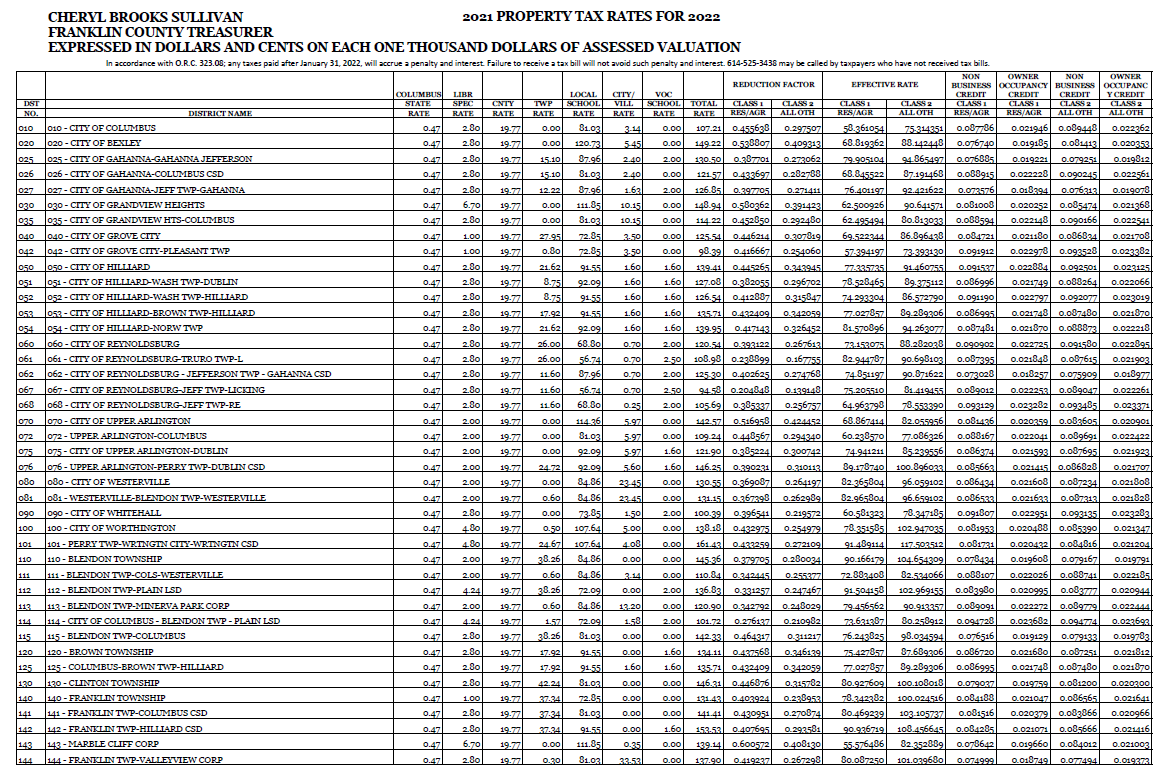

When paying your bill online the following convenience fee per transaction will be paid directly to Invoice Cloud and not Greene County Sanitary Engineering. You may pay online at treasurerfranklincountyohiogov Gross Real Estate Taxes for 2021 Tax Reduction Subtotal-Adjusted Tax Non-Business Credit 76885. Eastern time on the due date.

Credit and debit card limit is 25000000 with no minimum. Mail to Ohio County Treasurer PO Box. Please visit the Point and Pay website or select the link button below for payment and convenience fee details.

File your Ohio tax return electronically for free when you use the Ohio Department of Taxations secure online services. 1 Identify and select the property. To pay online through Point Pay click here.

Httpspaypaygovus Look up by name parcel number or address. Pay Taxes Online You may pay your real estate taxes online subject to a convenience fee. Credit and debit cards are charged a 24 convenience fee with a 200 minimum charge and electronic checks are charged a 100 flat fee.

Theres nothing better than knowing your Ohio property tax bill is paid on time on your time every time. Ohio County Sheriffs Tax Office 1500 Chapline St. Its fast easy secure and your payment is processed immediately.

Online Click here to pay online through our payment processing partner Point Pay. Franklin County Ohio Real Estate Taxes for 2nd Half 2021 Due Date 6212022 Office Hours. The payment processor will add the following fees to your total at checkout.

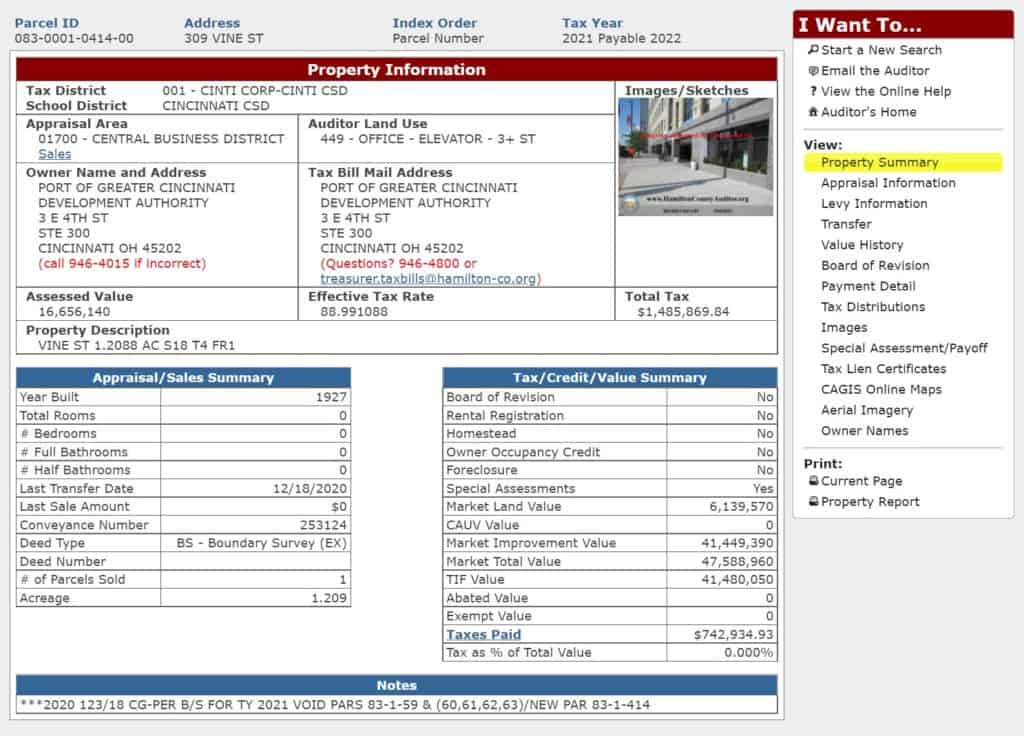

A person can pay their taxes in person at Room 405 of the County Administration Building 138 East Court Street Cincinnati Ohio or by mail while a team can receive payments electronically. Please have your bill ready so necessary information can be found. A convenience fee will apply see below.

This fee is in no way charged by the Hamilton County Treasurers Office. Point and Pay is authorized by the Union County Treasurer to. Online Bill Pay PAY YOUR STARK COUNTY PROPERTY TAXES ONLINE Pay Real Estate Tax Pay Manufactured Homes Tax Remember - you will be charged a convenience fee for this service.

You may pay with checks money orders Discover cards NOVUS VISA MasterCard and American Express cards. St Cleveland OH for check or. Make a debitcredit or eCheck payment online.

Click here to pay.

Ohio Sales Tax Small Business Guide Truic

New Portal Makes It Easier To Pay Cuyahoga County Tax Bills Online Cleveland Com

Income Tax City Of Gahanna Ohio

Franklin County Treasurer Home

Sales Tax On Grocery Items Taxjar

Cuyahoga County Property Tax Deadline Pushed Back To Feb 10 Wkyc Com

Ohio Tax Forms 2021 Printable State Ohio It 1040 Form And It 1040 Instructions

County Tax Office For Residents Ohio County Wv The Official Site Of The Ohio County Commission

Pay Online Department Of Taxation

Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Tax Information City Of Fairview Park Ohio

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Find Tax Help Cuyahoga County Department Of Consumer Affairs

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com